The Bogleheads Guide to Investing⁚ A Comprehensive Overview

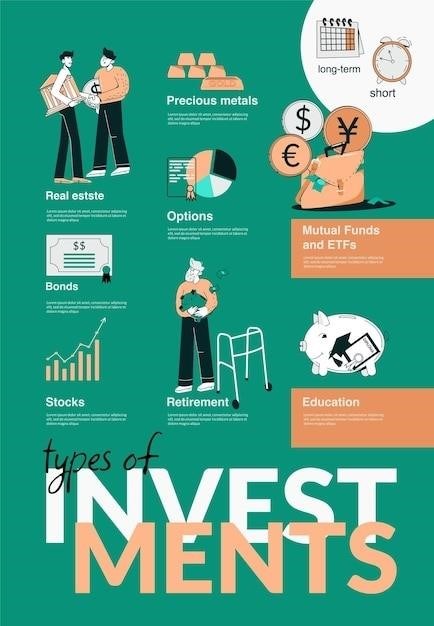

This guide, written by long-time Bogleheads.org forum members, provides a comprehensive overview of investing, focusing on the principles espoused by John C. Bogle, the founder of The Vanguard Group. It covers topics such as stocks, bonds, mutual funds, ETFs, taxes, asset allocation, and more, offering practical advice and examples for investors of all levels.

The Bogleheads Philosophy⁚ A Guide to Successful Investing

The Bogleheads philosophy, rooted in the teachings of John C. Bogle, emphasizes a long-term, passive investing approach that prioritizes simplicity, low costs, and diversification. It advocates for index funds and ETFs as the primary investment vehicles, believing that active management, with its higher fees and potential for underperformance, rarely justifies the added complexity. The Bogleheads philosophy rejects the notion of market timing and performance chasing, emphasizing that consistently investing over time is more crucial than trying to predict market movements.

The book delves into the importance of understanding your investment goals, time horizon, and risk tolerance, highlighting that a personalized strategy is key. It stresses the need for a well-defined asset allocation strategy, which determines the proportion of your portfolio invested in different asset classes like stocks, bonds, and real estate. The core principles of the Bogleheads approach are designed to help investors navigate the complexities of the financial markets and achieve long-term financial success. This approach, while seemingly straightforward, is grounded in solid financial principles, backed by decades of academic research and real-world experience.

The book challenges traditional investment wisdom, encouraging investors to question the conventional advice often promoted by Wall Street. It encourages a DIY approach to investing, empowering individuals to take control of their financial future. The Bogleheads approach emphasizes the power of compounding, where returns are reinvested to generate further returns over time. The book provides practical guidance for investors at all stages, from beginners to seasoned veterans. It encourages a disciplined approach to investing, emphasizing the importance of staying focused on long-term goals and avoiding emotional decisions driven by market fluctuations.

Key Principles of the Bogleheads Approach

The Bogleheads approach is built upon a foundation of key principles that guide investors toward long-term financial success. These principles are grounded in sound financial theory and have been proven effective through decades of real-world experience. Central to this approach is the belief that investing should be simple, cost-effective, and focused on achieving long-term goals. The Bogleheads advocate for a passive investing strategy, emphasizing index funds and ETFs as the preferred investment vehicles.

They strongly discourage active management, arguing that its higher fees and potential for underperformance rarely justify the added complexity. The Bogleheads believe in the power of diversification, spreading investments across different asset classes to mitigate risk and enhance returns. This approach emphasizes the importance of a well-defined asset allocation strategy, which determines the proportion of your portfolio invested in stocks, bonds, and other asset classes.

The Bogleheads philosophy also emphasizes the importance of keeping costs low. They advocate for low-cost index funds and ETFs, which track specific market indexes without attempting to outperform them. They believe that high fees can significantly erode investment returns over time, making it essential to minimize them. The Bogleheads approach encourages a long-term perspective, emphasizing the importance of staying focused on your financial goals and resisting the temptation to chase short-term market trends. They believe that consistent investing over time, regardless of market fluctuations, is the key to building wealth.

The Practical Guide⁚ A Step-by-Step Approach to Investing

The Bogleheads Guide to Investing goes beyond theoretical principles, providing a practical, step-by-step approach to implementing their philosophy. This guide offers actionable advice for investors at all stages of their journey, from beginners to seasoned veterans. The book begins by addressing the essential foundation for successful investing, emphasizing the importance of establishing a sound financial lifestyle and understanding your financial goals. It then guides readers through the process of determining their investment timeframe and risk tolerance, crucial factors in designing an appropriate portfolio.

The guide delves into the specifics of choosing investments, explaining the benefits of low-cost index funds and ETFs while highlighting the potential pitfalls of active management. It covers the basics of asset allocation, providing clear instructions on how to diversify your portfolio across different asset classes to mitigate risk and maximize returns. The book also addresses tax considerations, offering practical strategies for minimizing your tax burden and maximizing your after-tax returns.

Throughout the guide, the authors emphasize the importance of staying focused on your long-term goals, avoiding emotional decision-making, and resisting the allure of market timing or performance chasing. They provide valuable insights on managing your portfolio over time, including strategies for rebalancing, tracking your progress, and making necessary adjustments as your circumstances change. The Bogleheads Guide to Investing aims to empower readers with the knowledge and tools they need to take control of their financial futures and achieve their investment goals.

Understanding Index Funds and ETFs

The Bogleheads Guide to Investing dedicates significant space to explaining the benefits of index funds and exchange-traded funds (ETFs), two key cornerstones of their investment philosophy. Index funds, as the name suggests, are designed to track the performance of a specific market index, such as the S&P 500 or the NASDAQ 100. They aim to mirror the overall market’s performance, providing a diversified exposure to a wide range of companies within a particular sector or asset class. ETFs, on the other hand, are similar to index funds but are traded on stock exchanges like individual stocks. They offer a more liquid and efficient way to invest in a particular index or asset class.

The guide emphasizes the advantages of index funds and ETFs over actively managed mutual funds, highlighting their lower expense ratios, reduced trading costs, and improved tax efficiency. It explains that actively managed funds often struggle to outperform their benchmark indices after accounting for fees and expenses, making index funds and ETFs a more cost-effective and generally more efficient investment strategy. The book also provides practical guidance on choosing the right index funds and ETFs for your specific portfolio, emphasizing the importance of considering factors like expense ratios, asset class diversification, and investment goals.

By demystifying the concepts of index funds and ETFs, The Bogleheads Guide to Investing empowers readers to make informed decisions about their investments, helping them to build diversified portfolios that align with their financial goals and risk tolerance. It provides a clear understanding of the benefits of passive investing, encouraging readers to embrace a long-term perspective and avoid the pitfalls of active management.

Asset Allocation⁚ Building a Diversified Portfolio

The Bogleheads Guide to Investing emphasizes the importance of asset allocation as a cornerstone of successful investing. The book explains that asset allocation, the process of dividing your investment portfolio among different asset classes such as stocks, bonds, and real estate, plays a crucial role in mitigating risk and maximizing returns over the long term. The guide stresses the importance of diversification, highlighting that investing in a variety of asset classes can help to reduce the overall volatility of your portfolio, making it more resilient to market fluctuations.

The book provides practical guidance on determining the appropriate asset allocation for your individual circumstances, taking into account factors such as your investment goals, time horizon, risk tolerance, and financial situation. It discusses various asset allocation strategies, including the popular “three-fund portfolio” approach, which involves investing in a low-cost stock index fund, a low-cost bond index fund, and a low-cost international stock index fund. The guide also explores the role of other asset classes, such as real estate and commodities, in a diversified portfolio, providing insights into their potential benefits and risks.

The Bogleheads Guide to Investing emphasizes the importance of maintaining a long-term perspective when it comes to asset allocation. It advises against making frequent changes to your asset allocation based on short-term market fluctuations, emphasizing the need to stay disciplined and adhere to your chosen strategy over time. The book emphasizes the importance of regularly rebalancing your portfolio to ensure that your asset allocation remains in line with your investment goals and risk tolerance, helping you to stay on track for long-term financial success.

Managing Costs and Fees⁚ The Importance of Low-Cost Investments

The Bogleheads Guide to Investing places a strong emphasis on the importance of minimizing investment costs, particularly fees, as a key factor in achieving long-term investment success. The guide argues that high fees can significantly erode investment returns over time, highlighting the importance of choosing low-cost investment vehicles. It explains that even small differences in fees can have a substantial impact on your overall investment performance, especially when considering the compounding effect of returns over the long term.

The book advocates for investing in low-cost index funds and exchange-traded funds (ETFs) as a means of minimizing fees. It explains that index funds and ETFs track specific market indexes, such as the S&P 500, and aim to replicate their performance, typically with lower fees compared to actively managed mutual funds. The guide argues that actively managed funds often struggle to outperform the market, and their higher fees can significantly reduce investor returns. It emphasizes that low-cost index funds and ETFs provide a cost-effective way for investors to gain broad market exposure without sacrificing performance.

The Bogleheads Guide to Investing also discusses other investment costs, such as trading commissions, brokerage fees, and fund expenses, emphasizing the need to be mindful of these expenses and choose investment strategies that minimize them. It provides practical advice on how to compare investment costs, highlighting the importance of looking beyond annual expense ratios and considering other factors, such as trading fees and fund turnover. The guide encourages investors to prioritize low-cost investment options as a means of maximizing their potential returns and achieving their financial goals.

Tax Considerations⁚ Minimizing Your Tax Burden

The Bogleheads Guide to Investing recognizes that taxes are an integral part of investing and can significantly impact returns. The guide provides a comprehensive overview of tax considerations for investors, emphasizing the importance of minimizing your tax burden while maximizing investment returns. It delves into various tax-efficient investment strategies, including the use of tax-advantaged accounts like IRAs and 401(k)s, which allow for tax-deferred growth and tax-free withdrawals in retirement.

The guide explains the different types of taxable accounts and the implications of capital gains taxes on investments. It provides practical guidance on tax-loss harvesting, a strategy that involves selling losing investments to offset capital gains and reduce your tax liability. The guide also discusses the tax implications of different investment vehicles, such as mutual funds, ETFs, and bonds, highlighting the importance of choosing investments that align with your tax goals.

The Bogleheads Guide to Investing emphasizes the importance of understanding the tax implications of your investment decisions. It stresses the need to develop a long-term tax strategy that minimizes your tax liability and maximizes your after-tax returns. The guide provides valuable insights into the tax aspects of investing, equipping readers with the knowledge and tools to make informed decisions that optimize their financial outcomes.

Avoiding Common Investor Mistakes⁚ Staying on Track for Long-Term Success

The Bogleheads Guide to Investing emphasizes that avoiding common investor mistakes is crucial for achieving long-term investment success; It delves into the psychological and behavioral factors that often lead investors astray, such as market timing, performance chasing, and emotional biases. The guide highlights the dangers of trying to time the market, emphasizing that it is nearly impossible to consistently predict market movements and that attempting to do so often leads to poor investment decisions.

The guide also addresses the tendency of investors to chase past performance, often investing in funds that have recently performed well without considering their long-term track record. The guide warns against this approach, emphasizing that past performance is not necessarily indicative of future results. It stresses the importance of focusing on the fundamentals of a company or investment, rather than being swayed by short-term market fluctuations.

The Bogleheads Guide to Investing provides practical tips for staying on track for long-term success, including the importance of developing a well-defined investment plan and sticking to it, avoiding emotional decisions, and maintaining a disciplined approach to investing. It emphasizes the benefits of a long-term perspective, highlighting the power of compounding returns over time. The guide provides a framework for avoiding common investor pitfalls and making informed decisions that support long-term financial goals.